As the interest rate swap market continues to grow, industry participants are aware that inefficiencies due to hedging off the-run positions with on-the-run swaps can lead to significant mismatches within trading books. Banks tend to quantify trading risk by dividing the entire curve into risk buckets, each one covering different sets of maturities. The positions within each bucket are summed to provide a net risk for that part of the curve. Risk buckets are usually quoted in terms of DV01 and there is often a cost associated with running these off-the-run positions.

IRS DeltaMatchTM leverages GFl’s successful SWITCH ENGINE®, along with its existing auction-based technology. Our RISKEQUIVALENTS® analysis provides customers with a delta-neutral portfolio, allowing dealers to mitigate unwanted risk.

|

CORE ISSUES

|

ADVANTAGES

|

|

• Short and long positions along the curve, although potentially delta neutral overall, can create unwanted curve risks and P&L swings.

• Lack of liquidity in the off-the-run maturities currently makes the process of executing switches time consuming, inefficient and costly.

• Multiple buckets of risk along the curve can consume capital requirements and be expensive to fund.

SOLUTION

• Scheduled to run at specific times of the day based on market consensus.

• A centralized clearing for traders, risk control departments and end users.

• Dealers submit positions to be traded (either in the form of notional or DVOl for each risk bucket) along with their mark to market curve.

• IRS DeltaMatch™ generates a “Fair Value” fixing curve based on an aggregation of submitted market midpoints..

• Dealers can compare their submissions with the fixing curve and choose to change positions if required

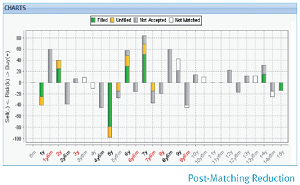

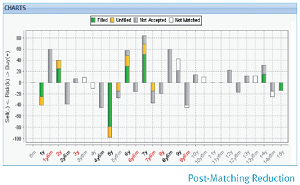

• IRS DeltaMatch™ runs an optimized algorithm, with our RISKEQUIVALENTS® analysis generating a series of delta-neutral suggestions between tradable counterparties (utilising our CREDITPREFERENCES® counterparty credit matrix).

• Dealers can select strategies such as spreads including curve steepeners or flatteners, butterflies and spread/spreads.

• Dealers can pre-negotiate strategies such as spreads including curve steepeners or flatteners, butterflies and spread/spreads, utilising our TERMNEGOTIATION® engine.

• All trades are executed using the transparent levels on the fixing curve.

|

• Fast and efficient way to eliminate illiquid bucket risk.

• All positions are anonymous to dealers and brokers.

• Reduces reserves and capital requirements against off-the-run and illiquid positions.

|